Source: https://www.pexels.com/photo/close-up-photo-of-ledger-s-list-164686/

Exploring the options between leasing, loans, and seller financing could be the financial kickstart you need today. Each of these choices has strengths and weaknesses that suit different financial situations. Maybe leasing gives you flexibility, loans the ownership with a side of interest, or seller financing is an alternate route when traditional banking isn’t your friend. It’s important to understand which option aligns with your current and future goals.

Leasing: The Power of Flexibility

Leasing is essentially renting with an agreement to use a specific asset owned by someone else. Think of it like renting a car or apartment without the commitment of ownership. Many businesses opt for leasing machinery, vehicles, or office spaces because it allows them to use the asset without the immediate financial burden of buying it. You get access to the latest and greatest without worrying about obsolescence. However, this does come with the caveat of eventual return; you never truly own it. When flexibility and lower upfront costs outrank ownership, leasing is your go-to choice.

Leasing agreements often come with maintenance services included, which can relieve the user from additional upkeep costs, thus proving economical in the long run. Furthermore, shorter leasing agreements mean that there is the opportunity to upgrade more frequently, ensuring that you are always equipped with assets that have state-of-the-art technology. This nimbleness can prove to be an advantage in sectors where technological advancements are especially rapid.

Loans: Ownership at a Cost

Loans? They’re what pop into your mind when thinking about mortgages, student loans, or auto loans. Simply put, loans are agreements wherein a bank or financial institution gives you capital, and you promise to pay it back with interest. The benefit? Once you pay off your loan, the asset is entirely yours. The downside? Interest payments can significantly increase the amount you end up paying. If your financial foundation is strong and you’re certain that the value you’ll derive from owning an asset outright will surpass the interest burden, loans become quite attractive. They pave the path to outright ownership.

When opting for a loan, the borrower must be prepared for fluctuations in interest rates, which could affect the cost of repayments over time. It’s not just about the money you borrow but also about the terms and conditions you agree to. Being diligent about reading through and understanding these terms can save a lot of hassle. Establishing a solid relationship with your creditors can also provide you with more favorable restructuring options if you find yourself in unexpected financial hardship.

To gain further insights into financing methods for purchasing a small business, particularly with a focus on SBA loans and seller financing, consider visiting https://acquira.com/financing-small-business-purchase. This resource outlines various strategies and requirements to navigate this complex field effectively.

Seller Financing: The Alternative Path

Seller financing is relatively less explored compared to the mainstream options of loans and leasing. Here, the seller of a product or property basically agrees to “be the bank” and offers to finance the buyer directly. This kind of arrangement is particularly appealing when dealing with real estate property. With potential for creative arrangements, seller financing can lower barriers to acquisition, especially for those who might have difficulty getting a traditional loan. However, keeping an eye on the possible higher interest rates and shorter payback periods is vital when considering this option.

Seller financing agreements are often built on trust, requiring both parties to clearly communicate and align their expectations. Buyers should ensure that they discuss all the details, like down payment size, interest rates, and repayment schedule, upfront. Both parties should also have thorough legal agreements in place to protect their interests should complications arise. While some may consider this route risky, a well-structured seller financing agreement can prove advantageous for both buyer and seller, particularly in non-traditional markets.

Crafting Your Decision Toolkit

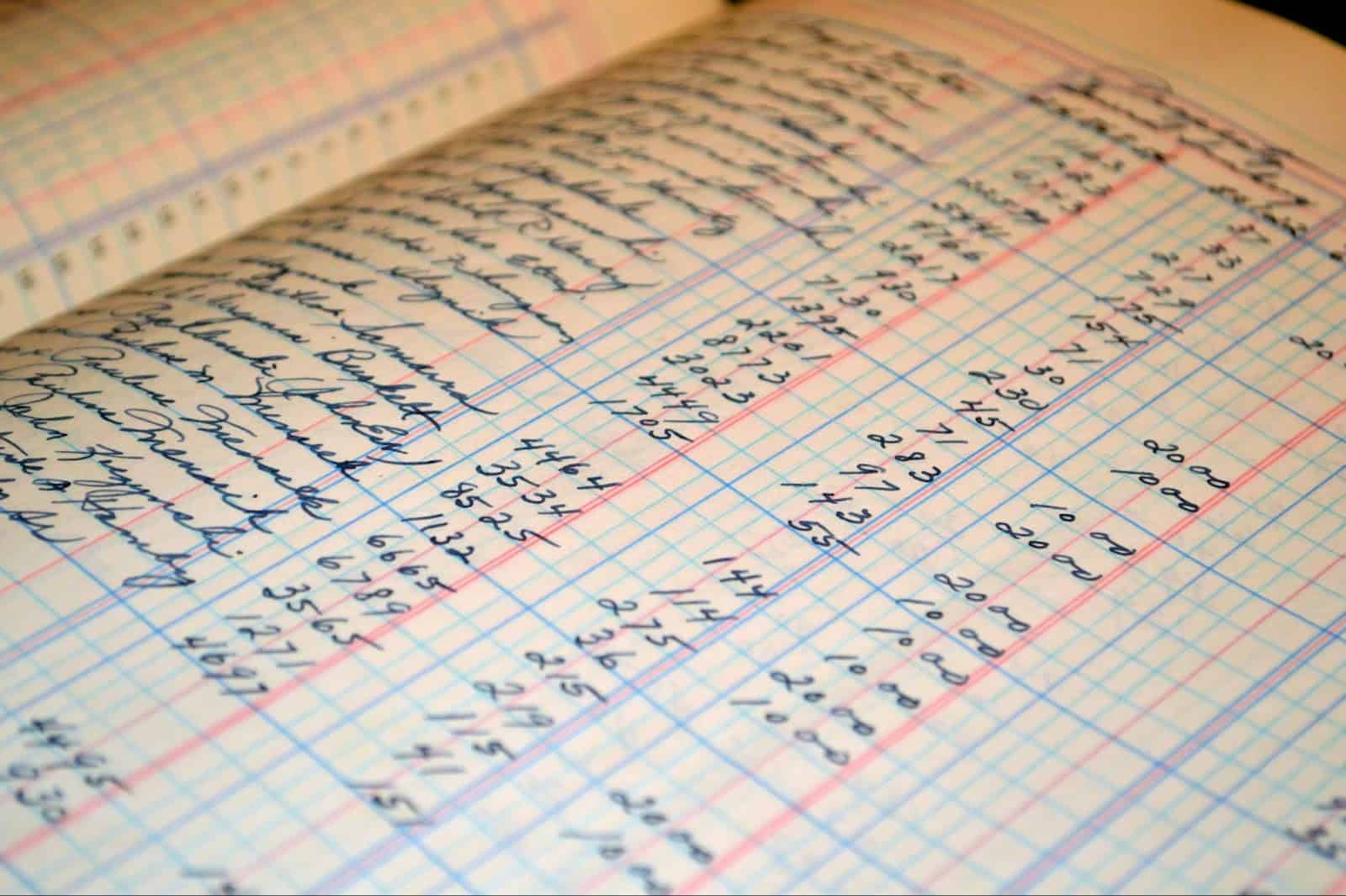

Choosing between leasing, loans, or seller financing is no walk in the park. You need to approach this with a toolkit that includes a clear understanding of your financial health and goals. Do you need flexibility or the eventuality of full ownership? Is your credit history allowing you to access favorable interest rates with traditional lenders? Perhaps seller financing provides an avenue when you’re less bankable. Get ready to put everything on a spreadsheet – numbers, advantages, pitfalls – so you can see the big picture. Analyze not only your current capital but also future cash flows and financial forecasts.

Deciding on a financing option is also about timing. The current economic climate, including inflation and interest rate levels, can greatly influence which path is most suitable. Keeping abreast of market trends and predictions will arm you with the necessary knowledge to make informed decisions. Consider consulting with financial advisors or peers who have previously made similar decisions for additional perspective, as real-world insights can often supplement theoretical information effectively.

The Choice is Yours

The option you choose should resonate with your personal aspirations, financial realities, and calculated anticipation of future circumstances. Leasing can be your ally when flexibility takes the stage. Conventional loans provide ownership, with a cost attached in the form of interest. And seller financing could be the unconventional solution when traditional routes seem barricaded.

Financing decisions are inherently personal, and this choice molds the financial opportunities and challenges you will face. So, ponder deeply, do your research, read the fine print, and always consider seeking financial advice tailored to your unique scenario.