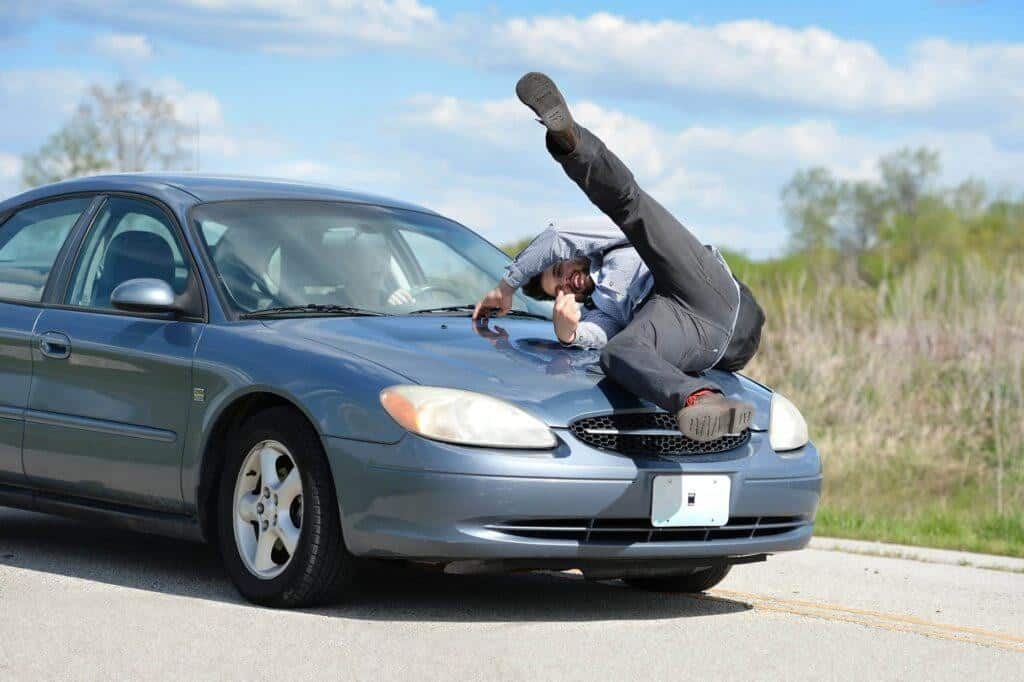

A hit and run crash happen when a driver in an accident flees the scene without stopping to give contact details or provide help. Such accidents can be stressful, particularly when it comes to processing insurance claims. Knowing how insurance works when it comes to such incidents helps one understand what to do next.

What Do You Do After a Hit and Run Crash?

First, ensure you and any passengers are secure. Dial emergency services instantly to report the accident and seek medical assistance if necessary. Take note of any information regarding the other vehicle that you can recall, including its make, model, color, or license plate number. Gather evidence by capturing photos of the accident site, your car, and any injuries.

Hit and run crashes are not taken lightly by police. You can even seek advice from a car accident lawyer about legal issues surrounding multi-vehicle crashes.

Does Insurance Cover Hit and Run Accidents?

If you carry collision coverage on your car insurance policy, it generally covers your vehicle for damage in a hit and run. Furthermore, uninsured motorist property damage (UMPD) coverage can assist if the state in which you live permits it. UMPD is not mandatory in most states but is strongly suggested to pay for instances such as hit and run accidents.

The following are typical insurance coverages that can be applicable:

- Collision Coverage: Covers damage to your vehicle, no matter who was at fault.

- Uninsured Motorist Coverage: Covers medical expenses if the at-fault driver is unknown or uninsured.

- Uninsured Motorist Property Damage (UMPD): Pays for property damage caused by a hit and run.

How Do Insurance Companies Handle Hit and Run Claims?

When you make a hit and run claim, your insurer will:

- Investigate the Incident: They will request police reports, photos, witness statements, and any other information.

- Assess Damages: The insurance company will send an insurance adjuster who will look at your car and other damages to come up with an estimate of repair costs and other expenses.

- Determine Coverage: They will review your policy to determine what damages your insurance can cover.

- Payout Process: If covered, the insurer will pay for repairs or medical expenses, minus the deductible.

Remember, making a false claim can earn you serious penalties, such as cancellation of your policy.

Do You Need a Police Report for a Hit and Run Accident Claim?

Yes, police reports are official reports made by the officer who responds to your accident and investigates the scene. As it is a neutral and official piece of evidence that contains the details of the accident, you can present it to your insurance company.

The National Highway Traffic Safety Administration (NHTSA) advises always reporting hit and run accidents to the police, even in the absence of injuries, in order to safeguard your legal and insurance rights.

What Happens If the Other Driver Is Found Later

If the hit and run motorist is discovered after your claim is settled, your insurance company may recover from the at-fault driver’s insurer. You may also be able to sue the liable party for further damages not included in your policy.

Key Takeaways

- Always report the hit and run incident to the police and collect evidence promptly.

- Collision and Uninsured Motorist Property Damage (UMPD) covers hit and run damages.

- A police report is required for insurance claims.

- Insurance firms investigate the accident and determine coverage according to your policy.

- If the offending driver is located, additional legal action or compensation might ensue.

Being aware of your insurance policy and procedures after a hit and run can assist you in dealing with this difficult scenario more efficiently.